how to open tax file malaysia

An employee who is subject to monthly tax deduction. Scroll down until you see Muat Naik Disini where youll need to upload a copy of your Identity Card.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days.

. Select e-Filing PIN Number Application. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. The following entities and accounting firms in Malaysia must file their taxes.

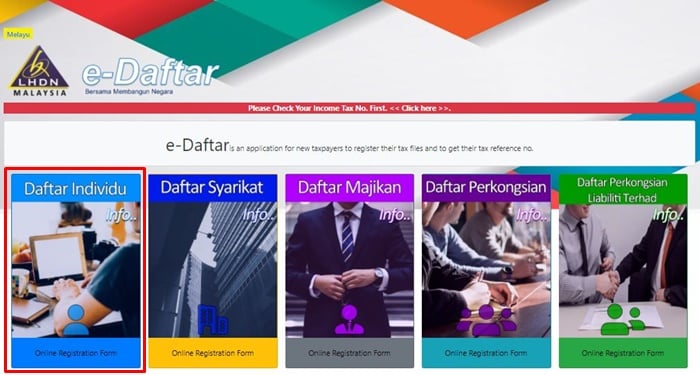

Fill in the required information. Call 03-8911 1000 local or 03-8911 1100 overseas. Go to httpedaftarhasilgovmy to apply for your Income Tax Reference Number.

Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the. Before you try any other ways to open TAX files start by double-clicking the file icon. According to the Inland Revenue Board IRB of Malaysia aka Lembaga Hasil Dalam Negeri LHDN a Malaysian individual who earns an annual income of RM34000 after EPF deduction must register a tax file and file annual tax returns.

Its possible you may need to download or purchase the correct application. In the left pane of the search results select the symbol next to the tax file youre searching for. The file should open automatically.

Click Online Registration Form Borang Pendaftaran Online fill in your details and log in to your account. This will bring up information about this file in the right pane. File extension tax2020 is mainly related to the TurboTax - a tax preparation and financial software for Microsoft Windows and macOS OS X operating systems.

There are many different programs you can use to. Number can be seen clearly and the file must be in gif format. Call the LHDN Inland Revenue Board and be prepared to give them your IC or passport number.

Copy of the partnership business registration certificate issued by the Companies Commission of Malaysia SSM 5. Make sure your email address is correct because LHDN will send a reference number to your email. In-person registration is available at any Inland Revenue Board of Malaysia office or Urban Transformation Centre UTC branch.

You must be wondering how to start filing income tax for the. The file size also must be between 40k and 60k and the file name must be in alphanumeric only. Login to e-Filing and complete first-time login.

Individual who has income which is taxable. A businessperson with taxable income. Bring along your supporting documents.

Particulars Of Change Or Alteration Relating To Foreign Company under subsection 567 1 Companies Act 2016. How To Check Income Tax File Number Malaysia. Browse to ezHASiL e-Filing website and click First Time Login.

How to File Income Tax in Malaysia 2021 LHDNAre you filing your income tax for the first time. Make sure to scan the front so your name and IC. Fill up this form with your employment details.

In the right pane select Open file location. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Unregistered companies with IRBM.

Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing. A tax2020 file stores tax return financial data for year 2019 prepared in TurboTax program. An individual who earns an annual employment income of RM25501 after EPF deduction has to register a tax file.

Launch a tax file or any other file on your PC by double-clicking it. Review all the information click Agree Submit button. Choose the Right Program.

Used mainly in USCanada. Fill up PIN Number and MyKad Number click Submit button. A list of offices and branches where you can register is available on the Inland Revenue Board of Malaysia website.

By default TurboTax saves tax files in the My Documents TurboTax folder. Copy of the notice of registration of the conversion to LLP under section 32 of the Limited Liability Partnership Act. If it doesnt open or you see an error message move on to Step 2.

With effect year 2010 an individual who earns an annual employment income of RM26501 after EPF deduction has to register a tax file. If your file associations are set up correctly the application thats meant to open your tax file will open it. Therell be a text box to enter your PIN number and your IC number and upon login youll need to fill a form with details such as full name address phone number and also a password for future logins.

At the IRB office ask for the form to register a tax file. Software that will open tax2020 file. As for your e-Filing PIN you can go to LHDNs website.

A business or company which has employees and fulfilling the criteria of registering employer tax.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

How To File Your Taxes For The First Time

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Personal Income Tax E Filing For First Timers In Malaysia Mypf My